About Louisiana Flood Insurance

We had one goal in mind…

That everyone should be able to protect their family, their home, and their assets in the event of a flood.

Louisiana Flood insurance was established to aid with the rising need for flood insurance. Many property owners are unaware that damages incurred from flood events are not typically covered by homeowners insurance policies; because of this, homes and businesses are not protected when flood damage occurs unless they carry a separate flood insurance policy. Louisiana Flood Insurance was founded after severe flooding occurred in the Melbourne, Florida, area – where its parent company, National Flood Insurance, LLC, is based – following Tropical Storm Fay in 2008. After the flood waters receded, it quickly became apparent that flood insurance coverage was sorely needed, and the company began expanding to states beyond Florida.

In 2010, Louisiana Flood Insurance opened shop, and prides itself on being a leader in the flood insurance industry. The flood insurance specialists at Louisiana Flood Insurance strive to make purchasing flood insurance coverage hassle-free though education and efficient customer service to the property and business owners who make Louisiana their home. With the devastation caused by Hurricane Katrina in 2005, it is apparent that there is a great need to not only protect lives, but to also ensure that valuable material assets are also safeguarded.

Buying flood insurance should be a simple thing – and at Louisiana Flood Insurance, we make sure it is.

Why Is There Such a Need for Flood Insurance?

All too often, flood insurance is overlooked when purchasing a home or business. In Louisiana, it is extremely important to include it among the top priorities. This is especially true for those who live in areas like Baton Rouge and New Orleans both of which sit well below sea level. This does not mean that other areas aren’t in flood zones. Louisiana, like many other states along the Gulf Coast, is no stranger to hurricanes and flood events. With every hurricane season comes the risk of potentially disastrous flooding due to not only hurricanes, but heavy storms and river flooding, as well. Less than a month after Hurricane Katrina, Hurricane Rita worsened the damage with a storm surge that topped levees and shoved water further inland, flooding many parishes and cities, including Lake Charles, Houma, and Cameron Parish.

In Louisiana, home and business owners alike are hopefully aware that a severe rainstorm can produce excessive rainfall and flooding which may cause large-scale damage to one’s home, condo, or business. But it doesn’t take flooding of great magnitude to cause extensive damage – in fact, as little as an inch of water can cause hundreds or thousands of dollars worth of damage, which can take months or sometimes years to repair. In addition to the costs of direct flood damage, property owners should also bear in mind the secondary costs that can accompany flood events. These may include temporary housing or business locations as well as lost revenue. All of these costs can add up quickly.

The time to give flood insurance coverage serious thought is before a flood event happens. Louisiana Flood Insurance endeavors to convey to renters, homeowners, and business owners that flood insurance is an independent part of a homeowners insurance policy and that it must be purchased separately in order to protect your most valuable material assets from flood damage.

Louisiana Flood Insurance and its dedicated agents are also committed to helping Louisiana residents safeguard their lives by providing education and addressing not only the flood insurance basics, but clarifying the common misconceptions as well.

Navigating the complexities of flood insurance doesn’t have to be stressful. Please call 1-888-900-0404 to speak with an expert flood insurance agent and receive a complimentary consultation which includes a flood zone determination for your home or business, a flood insurance quote, and to have all of your questions and concerns addressed. Please don’t risk not having flood insurance. Protect your properties and call today!

Get a Flood Insurance Quote in Louisiana Today – Online Quote Form

How It Works

Louisiana Flood Insurance, Flooding is the nation’s number one natural disaster. While floods occur in every area of the country, many property owners remain unprepared. Standard homeowners’ insurance does not cover flood damage.

Therefore, it is important to know what options are available to protect your assets from flood losses.

Get A Quote

We send you the lowest rates from multiple flood insurance carriers. You simply submit our online application in under 2 minutes! No one does it as quickly as we do!

Instant Coverage

We will send confirmation to your lender And email you a copy of your policy immediately! Making a payment is easy! You can pay online or we can bill your mortgage company. We do all the heavy lifting.

Enjoy the savings..

Just think what you can do with the money and time you saved! Join over 12,000 customers who have made the switch! Do the math! See our google reviews below!

Looking for help with your new or existing flood insurance policy?

Anytime during normal business hours we’re here for you either by phone or chat support.

If it’s after hours, you can always send us an email and one of our agents will reply as quickly as possible.

Louisiana Flood Insurance

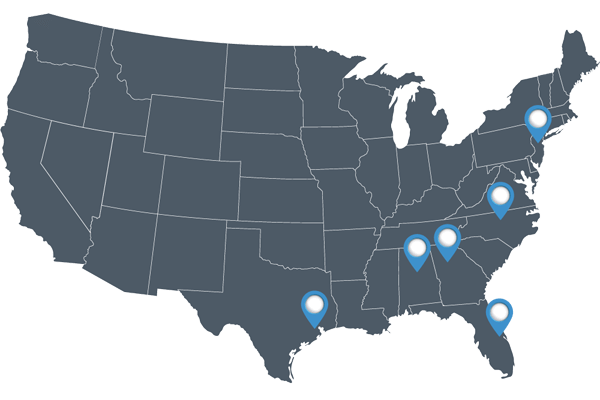

Louisiana Flood Insurance offers a variety of products for flood coverage, nationwide.

We pride ourselves on providing you access to our nationwide capabilities with the customer service of a small agency.

Contact to expert agents that offer over 60 years combined experience

To private carriers for better coverage options with lower premiums

More efficient turn-around time during any point of the process

Coverage options with higher limits (up to $10MM)